Texas Buys Bitcoin, ETF Selling has Slowed Down & Interest Rate Cut is Back on the Table

Listen to the Weekly Wrap on Spotify and Apple Podcasts. It is a summary with the help of AI-voices.

This Week’s Top Stories

“New York Fed President Williams sees near term room for a rate cut – odds for a cut instantly spiked above 80 percent.” – Friday, 21 November 2025

- You probably remember us talking about the drop in the odds of a Fed rate cut in December in our last Weekly Wrap, as odds dropped to 30 percent in a matter of hours. Right when we sent the newsletter out, New York Fed President John Williams released a statement in which he advocated for near term room for another rate cut, as employment risks have risen and inflation does not pose an increased risk.

- His comment was enough to completely turn around expectations for the December meeting, as odds for a rate cut on Polymarket are now above 80 percent.

“Former Coinbase Advisor, Kevin Hasset, emerges as frontrunner for the next Fed chair.” – Wednesday, 25 November 2025

- The whole world is waiting for President Trump to announce his pick for the next Federal Reserve chair, as Jerome Powell will be stepping down in spring next year. This week Bloomberg reported that Kevin Hassett has emerged as the frontrunner candidate for Donald Trump, as he is viewed as the most aligned with Trump’s wish for lower interest rates.

- Hassett is of particular interest to us crypto guys, as he previously served as an advisor to Coinbase and is to this day a shareholder, holding more than $1 million in Coinbase shares.

“The state of Texas purchased $5 million worth of BlackRock’s IBIT Bitcoin spot ETF.” – Wednesday, 25 November 2025

- We all remember that back in June, Texas established the Texas Strategic Bitcoin Reserve through Senate Bill 21 to hold Bitcoin as a long-term investment to hedge against inflation and economic volatility. This week they announced their first actual Bitcoin purchase, buying $5 million worth of BlackRock’s IBIT and becoming the first U.S. state to do so.

A Quick Crypto Overview: Crypto is Trending Higher This Week

Bitcoin and the broader crypto market have slowly been trending higher this week after bottoming last Friday, one day after the second highest outflows from the Bitcoin spot ETFs. The $80’000 level seems to have acted as an at least temporary bottom and Bitcoin is currently trading above $90’000 at the time of writing.

We mentioned in last week’s outlook that the risk reward ratio had shifted toward looking for entries, since historically 30 percent corrections in a bull market were often ideal entry points in retrospect. The question of course is whether we are still in a bull market or on track to repeat the infamous four-year cycle once more, with a complacency bounce on its way before Bitcoin and the crypto market trade lower into next year.

While our fundamental outlook in terms of economic conditions remains constructive into 2026, there is always a possibility that tides are shifting. It therefore makes sense to closely monitor how Bitcoin reacts if it trades closer to $100’000 over the coming weeks, since this psychological level has the potential to act as a place to turn around.

The FOMC meeting and interest rate decision in the United States is still one and a half weeks away, but Powell will be speaking on Monday, so eyes will be on this.

Gold traded mainly sideways this week, holding steady, and saw a small pop to the upside last night trading just below $4’200, while the S&P 500 is up more than 4.5 percent from last Friday’s low and the U.S. Dollar Index is down almost 1 percent since last Friday.

Most altcoins managed to recover some ground this week along with Bitcoin, with a few exceptions such as ZEC, down 25 percent this week, or STRK, down 40 percent. Both of these coins performed particularly well over the past weeks and are now seeing some rotation out into other projects.

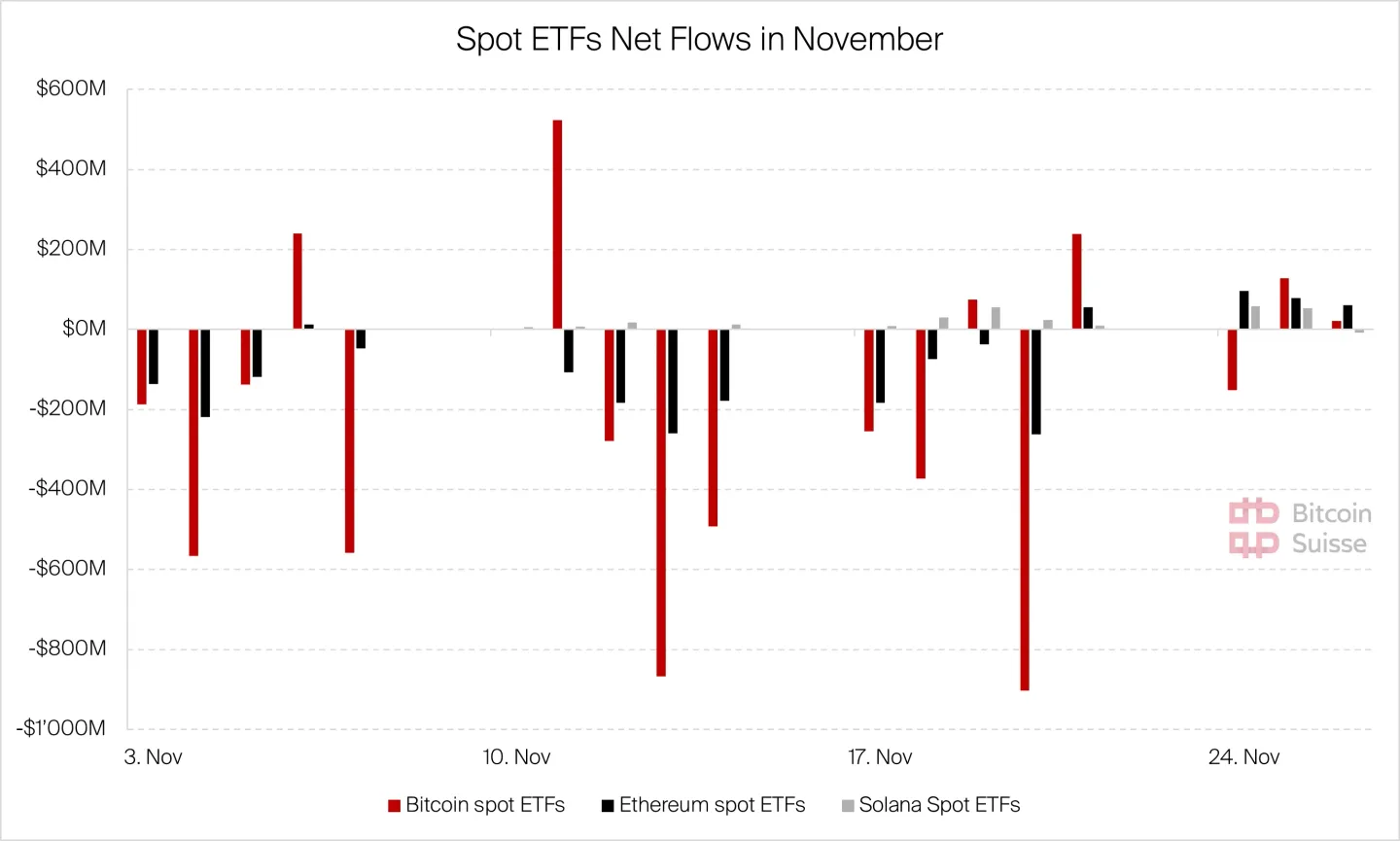

Chart of the Week: ETF Selling has Slowed Down This Week

As we mentioned in the last couple of Weekly Wrap editions, we want to keep a close eye on ETF selling and buying, since ETF flows are closely correlated with price action. Last Friday, the Bitcoin spot ETFs saw their second largest net outflow day, topping the outflows from two weeks earlier by a couple of tens of millions. This week, however, the selling in the spot ETFs has stopped as Bitcoin started bottoming and is trading above $90’000 at the time of writing. We will be keeping an eye on this over the coming days and weeks.

What’s Happening Onchain? Fusaka Upgrade, Bitcoin Mining & Prediction Markets

The Fusaka Upgrade is expected to take place on 3 December and aims to increase value capture for Ether, for instance by introducing a minimum fee for recording data from Layer 2 networks. Overall, the Fusaka Upgrade has the potential to have significant effects on revenue capture for Ethereum. We do not see many people talking about this yet, but we expect the market to catch up on the positive effects of Fusaka over the coming weeks. The recent developments for the UNI token with the vote on the fee switch also seem underreported, since a yes vote would direct roughly 16 percent of the trading fees toward burning UNI, a move that finally allows UNI holders to profit from activity on Uniswap.

In other news, according to Reuters, Bitcoin mining in China has been growing again after the 2021 ban and mining in the country contributed roughly 14 percent of the global hashrate at the end of October, putting China in third place worldwide. While crypto mining is officially still banned in China, CryptoQuant estimates that up to 20 percent of global Bitcoin mining currently operates out of China. It is widely expected that Bitcoin mining bans worldwide will continue to loosen in the future.

Eric Trump also made headlines recently in regard to Bitcoin mining, as he announced in a video on X that his company, the American Bitcoin Corp., mines roughly 2 percent of the world’s Bitcoin supply, when he likely meant to say that they are mining 2 percent of the daily mined supply, meaning 9 BTC, which is still impressive.

As we all know, prediction markets have been growing rapidly throughout the year, surpassing previous highs in volume and OI during the U.S. election in November 2024. Bloomberg reported this week that Galaxy Digital is in talks with Polymarket and Kalshi to provide liquidity on their platforms. According to Mike Novogratz, the firm is doing some small-scale experimenting but is exploring providing broader liquidity in the future. The entrance of large players such as Galaxy could provide much needed arbitrage and help fight price divergence between platforms.

Digital Asset Fund Flows: ETF Selling has Slowed Down

Last week, digital asset investment products saw net outflows of almost $2 billion, bringing the four-week total net outflows to almost $5 billion, the third largest outflow run 2018. Let that sink in.

Bitcoin, as always, led the race with almost $1.3 billion in outflows, followed by Ethereum with roughly $600 million. As mentioned earlier, this week’s flows look more constructive as the large outflows seem to be behind us and ETF participants are more balanced between buying and selling.

Last week Lookonchain presented an overview of the largest DATs for Bitcoin, Ethereum and Solana and compared their respective performance amid the market correction over the past two months. Strategy, the oldest and by far biggest DAT, was still up almost 13 percent last week with an average buying price of roughly $75’000 . All good so far, right? Well, if you look at Bitmine, the largest Ethereum DAT, it gets absurd. Bitmine’s average buying price for Ethereum is a staggering $4’000 and they were down more than 30 percent or $4.5 billion last week and are still down more than 20 percent on their investment today. Forward Industries, the largest Solana DAT, was down almost 45 percent on their investment last week with an average buying price of $232 . And people make fun of us retail participants, am I right?

Market Sentiment: Still in “Extreme Fear” but Slowly Turning Around

While the Crypto Fear and Greed Index is still in extreme fear territory (25) it is slowly improving as our last week’s bottoming call seems to be holding true so far. The sentiment in the stock market is also improving but it still appears like it could face some further downside over the coming weeks.

Below’s chart shows the Google Trends search data for “Crypto” and it appears like that the overall interest in crypto reached a multi-year high this past August, amid the DAT hype, but did not manage to spark more interest than back in May 2021, when Elon Musk was advocating for Dogecoin on Saturday Nightlife and on all his social media accounts. The Google Trends data resembles the price action for most crypto assets pretty well, as most of them traded higher over the past year, relative to their 2022 lows, but only very few managed to reach new all-time highs. It remains to be seen whether the search interest for “Crypto” now trades even lower, putting in a multi-year low, or, whether it manages to turn around and go for the highs again.

Other Relevant News

- Klarna has announced the launch of its stablecoin KlarnaUSD, aimed at reducing cross-border payment costs. The stablecoin is deployed on Stripe’s proprietary blockchain. – Link

- Polymarket announced that the CFTC has issued it an Amended Order of Designation, allowing the company to operate an intermediated trading platform in the United States under a fully regulated exchange structure. – Link

- Robinhood to launch new derivatives exchange for prediction markets push. – Link

- Tether becomes the largest independent holder of gold in the world, with only central banks owning more. – Link

- Grayscale files with the SEC to launch first-ever Zcash ETF. – Link

Looking Ahead: Where are we in the Cycle?

We all wish we could see the future, right? But all we can do is look at the past and compare the current situation with previous ones. When it comes to market sentiment, the recent weeks have been difficult for many and it compares to deep bear market levels back in 2022, as many market participants have completely lost hope for any rally in the near future. But is there a chance for it to happen, nonetheless? If history repeats and the four-year cycle holds true once more, then the chances are rather slim. But what if this time is different?

Market structure has shifted. Historically, the last year of a bull market has always been by far the strongest, but 2025 was nothing like that and most crypto assets are down year to date, so this is different from previous cycles. Moves to the upside have been less explosive and we have already seen two roughly 40 percent corrections in the total market capitalization before the latest downward trend.

Looking at the past, we could be in a similar situation as in July 2021, when the market continued to rally for half a year and even made new highs, or we are in a situation similar to January 2022, when the market was able to rally a bit but did not have the strength to make a difference and then continued to trade much lower throughout the whole year of 2022. There is also the possibility that we have not yet experienced a situation like this before and that we are entering a completely different regime.

Considering the S&P 500, which is currently up roughly 12 percent from the February highs before the whole U.S. tariff crash, and looking back at 2021, today looks more similar to the situation at the beginning of 2021, as the S&P 500 was already up more than 120 percent from the pre covid crash levels in January 2022.

Taking into account the interest rate cycle, the Fed started its tightening and interest rate hiking cycle in early 2022, whereas the Fed is now ending QT and is on track to keep cutting interest rates throughout next year.

We are in an interesting position right now and it is important to consider different possibilities, react to news and price action as they happen, and remember that the whole digital asset industry is still evolving and that there is big growth potential ahead of us over the coming years.

Below, you can find some of the key data releases and events to watch out for next week.

Monday, 1 December 2025

USA – Fed Chair Powell Speaks

USA – ISM Manufacturing Prices

Tuesday, 2 December 2025

Eurozone – CPI, Core CPI

USA – JOLTS Job Openings

Wednesday, 3 December 2025

Switzerland – CPI

Thursday, 4 December 2025

Switzerland – Unemployment Rate

USA – Initial Jobless Claims

Friday, 5 December 2025

USA – Core PCE Price Index, PCE Price Index

Eurozone – GDP

Eurozone – Employment Change